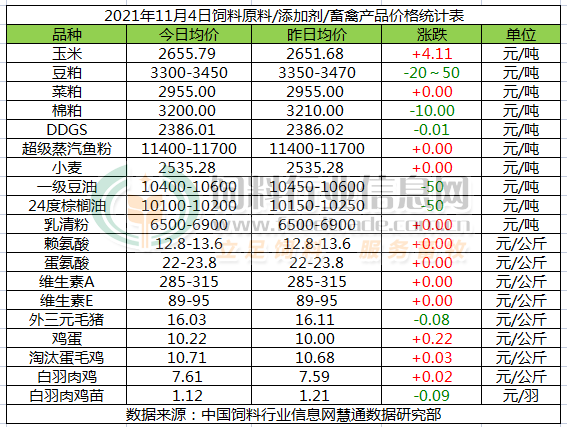

November 4, 2021 domestic feed market summary

Release time:

2021-11-05 10:27

Source:

Https://mp.weixin.qq.com/s/EgYLjesyPniaWyJmggFeDA

hand drawnBased on feed service animal husbandryhand drawn

MARKET COMMENTARY-FOCUS

corn]

Corn prices shock higher. New season corn moisture is high, high-quality corn supply moderately tight, feed enterprises in the early general inventory is not high, replenishment demand gradually recovered, promote corn spot continued to rise. The arrival time of winter in the main corn producing areas in the north this year is earlier than in previous years. The new season corn receiving season has encountered heavy rainfall. The current corn moisture is still high, and the supply of low-moisture and high-quality corn is moderately tight. It is expected that the overall corn price will continue to be moderately strong during the first half of November. The corn price in the latter half of the western half of the month has the chance of another weak correction.

soybean meal]

Operation tips: according to the weather forecast, the low temperature and dry weather in most parts of the Midwest and the Great Plains of the United States will help soybean harvest and market. The soybean producing areas in Brazil and Argentina in South America have better weather and sowing work is progressing smoothly. International crude oil futures are lower, long positions are closed and selling and technical selling are active. CBOT soybean futures market closed down. Domestic oil plant operating rate increased but downstream feed farming enterprises to pick up goods slowly, so that the recent low soybean meal stocks are expected to rebound. The rising cost of feed has led to poor demand for soybean meal at the livestock and poultry breeding end, which is already at a loss or with low returns. In addition, the impact of the national comprehensive implementation of the feed formula adjustment plan for low-protein diets such as coarse cereals, coarse meal and grain processing by-products on the reduction of soybean meal demand has already appeared. In addition, the high price of soybean oil has caused low stocks to strongly support soybean meal prices. In the United States soybean yield pressure and South American soybean production prospects are expected to be good background of loose market supply, oil strong meal weak pattern continued to strengthen, soybean meal market is still expected to continue the weak market in the near future.

rapeseed meal]

cottonseed meal]

Cottonseed meal is stable and weak. Cottonseed prices have fallen at a high level, and their cost support has declined. With the increase in the startup rate of oil plants, the supply pressure of cottonseed meal in the new season has gradually emerged. With the obvious disadvantage of the cost performance of cottonseed meal, the demand for cottonseed meal by feeding enterprises has shrunk significantly. Its short-term market presents a pattern of strong oil meal and weak meal. It is expected that cottonseed meal prices will be weak in the short-term.

[DDGS]]

wheat]

grease]

Super steam fish meal]

whey powder]

Recently, the European and American markets rose, domestic prices fell back to the annual low, whey powder market prices upside down, traders are reluctant to increase the willingness to sell, the price bottomed out.

lysine]

methionine]

Vitamin A]

Today, it is VA285-315 yuan/kg. On October 12, BASF said that the VA1000 equipment upgrade is in progress and the saleable quantity cannot be provided at present. It is expected to update the information in mid-November. On August 25, Jindawei announced that the 800-ton VA oil project in the new plant area would be trial-produced, and the old plant area would be relocated in due course according to the trial-run situation. On September 14, the market said that due to the supply of sodium methoxide, DSM VA plant stopped production until the end of September, reducing production by 30% in the fourth quarter. On October 21, the quotation of BASF vitamin and carotene products increased by 15% ~ 20%. The market is high and the price is high.

Vitamin E]

Today VE 87-95 yuan/kg, this week the European market rose to 8.6-9 euros/kg. Zhejiang Medical Changhai Biological Industrial Park has been overhauled for 45 days since July 25. The market reflected that there is a factory to stop reporting the willingness to raise prices, this week's purchase and sales active, strong operation. Market sources said that Yimante VE factory plans to stop production and upgrade in mid-September for 6 weeks. On September 23, the market reflected that there are factories in Europe that plan to cut production from October to November.

Outer three-yuan pig]

Today, pig prices have fallen more and risen less, and the rebound in the northern region has not been sustained. Today's decline is relatively obvious, with most areas in the southwest mainly rising. At present, the price of pigs is obviously stagnant, mainly because the market lacks pigs and meat. After the price of pigs rises, the wholesale price of white bars and the retail price of pork rise, the demand side begins to resist, and the production of cured products also slows down. Superimposed on the new round of epidemic, has now involved more than a dozen provinces and cities, some areas once again suspended gathering entertainment activities, going out to dinner also decreased, the impact on consumption again, the entire economic environment is also under pressure again, the market demand has a certain negative impact. We expect the prediction of weak pig price volatility during the first half of November to remain unchanged.

egg]

Knockout Chicken]

white feather meat chicken]

white feather broiler seedlings]

Today's white feather broiler seedling price stagflation correction. At present, the speed of hatching enterprises is not fast. Although the price of white feather chicken continues to rise, the increase is small, and the market is in a state of loss. Farmers are holding a wait-and-see attitude towards the price of white feather broilers in the future. The amount of supplement is limited. The market demand for chicken seedlings is insufficient and the price of chicken seedlings continues to rise. It is expected that the price of chicken seedlings will be weak in the second half of the week.

Note: The daily quotation summary deadline for each variety is 11:30, and the difference in statistical time will cause a small difference in the price of the day.

Related News

Recently, Xingtengke, in collaboration with the College of Animal Science at South China Agricultural University, has achieved an important breakthrough in the applied research on small peptide protein salts for layer chickens.

At the conference, Xingtengke was successfully elected as the 8th standing director unit of the association.

On November 7, 2024, the Fourth Egg Industry and Technology Development Conference, hosted by the Feed Industry Technology Innovation Strategic Alliance, was successfully held at the Huaju Grand Hyatt Hotel in Guangzhou.

On November 5th, Yan Tieshan, the Secretary-General of the National Egg Merchants Union and the General Manager of Hubei Jiameixian, along with a group of experts and leaders in the layer chicken industry from Henan and Hebei, visited our company for an inspection and exchange.

On October 24, 2024, the 14th (Northern) Young Layer Chicken Conference and Egg Chain Business Opportunity Matching Conference, hosted by Jidantang and Danqintang, was grandly held in Shijiazhuang, Hebei Province and achieved a complete success.

Xingtengke won the title of "Leading Enterprise in Nutritional Additives".

From July 14th to 16th, the 2024 Second Southern Animal Nutrition Development Forum was grandly held in Nanning, Guangxi.