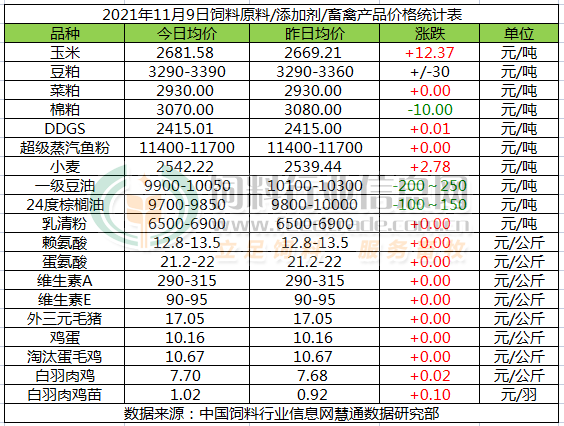

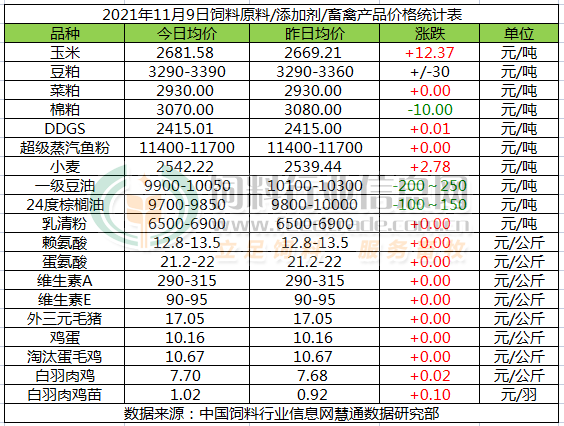

Corn prices continue to rise. Cold wave weather continues to affect the northeast production area of new grain volume and circulation, deep processing enterprises procurement volume again to a low level, enterprises have to continue to increase prices to promote volume. This year, the arrival time of winter in the main corn producing areas in the north is earlier than in previous years. The new season corn receiving season encountered heavy rainfall. The current corn moisture is still high, and the supply of low moisture and high-quality corn is moderately tight. Superimposed on the north in early November ushered in snowfall affecting logistics and transportation, it is expected that most of November corn prices generally continue to moderately strong trend-oriented, after the second half of the year with the further increase in corn supply, its price there is a weak correction opportunity.

Operational tips: Due to the high-yield listing of soybeans in the United States, Brazil's soybean sowing conditions have been almost ideal recently. There are signs that the purchasing pace of China, the number one buyer, has slowed down. The market estimates that the upcoming USDA November supply and demand report data may be negative. Traders adjust their positions before the report is issued, which has suppressed the soybean market sentiment. In addition, the United States and Brazil compete to export soybeans to China and other markets. Data show that the total amount of soybean export inspection in the 2021/22 year starting on September 1 decreased by 30.8 year on year. CBOT soybean futures market closed down. U.S. soybean 01 contract fell below 1200 cents/bushel, waiting for the guidance of the monthly supply and demand report. After the implementation of the domestic feed formula adjustment plan, the effect of the soybean meal reduction alternative is obvious, resulting in the demand side of the soybean meal pick-up no obvious improvement, soybean meal inventory to stop falling back, thus weakening the demand season on the support of soybean meal prices. However, the decline in soybean oil prices will make the cost conduction in soybean meal appear, or can trigger the oil mills on the soybean meal price will, but the short-term from the soybean meal itself active rebound power is insufficient, the soybean meal market is expected to continue the weak shock market.

Rapeseed meal is steadily finishing. Although U.S. beans continued to fall overnight, but the recent sharp decline in oil, the formation of support for the meal category, today Zheng meal low volatility is strong, spot is expected to adjust with the plate. The aquaculture peak season is basically over, the demand for rapeseed meal is gradually declining, dragging down the price of rapeseed meal, overlaying losses in pig farming, and the demand for protein meal is not good. However, the recent rebound in factory startup rate has increased rapeseed meal inventory, but the overall supply is still not much. Overlaying the expected tight state of global rapeseed, the expected high cost of imported rapeseed, the import volume in the later period is greatly reduced under the pattern of weak supply and demand, rapeseed meal is expected to follow the weak shock of soybean meal in the short term.

Cottonseed meal is stable and weak. Raw material cottonseed fell sharply, the supply of cottonseed in the new season was increasing day by day, the start-up rate of oil plants was increasing, and the supply of cottonseed meal in the new season was gradually increasing. In addition, the price of cottonseed meal continued to fall recently. Compared with the price of soybean meal, the price of cottonseed meal was obviously inferior to that of soybean meal.

DDGS fluctuates slightly. Corn alcohol industry operating rate is limited by multiple factors to maintain stability, raw material costs began to gradually rise, aquaculture demand into the end, livestock and poultry terminal demand performance is flat, downstream demand to promote the lack of continuity, is expected to be mainly DDGS strong adjustment in the short term.

Today's wheat prices continue to run mainly in a stable medium-to-strong situation. At present, the news of wheat auction has failed. The state encourages people to store daily necessities. The market is bullish again. Recently, the flour market has been active in purchasing and selling. Especially in areas affected by the new crown epidemic, flour mills consume a large amount of wheat, resulting in a continuous decrease in wheat stocks. In order to ensure the daily output of flour, flour enterprises are looking for food sources everywhere. Traders with stocks are tight in their pockets and are unwilling to ship. Milling enterprises, support the rise in wheat prices. Coupled with the delay in winter wheat planting, farmers in some areas have abandoned seeds, which has increased the bullish sentiment of wheat prices among wheat traders, supporting wheat prices to continue to rise, which has also strengthened the traders' reluctance to sell.

U.S. soybean oil continued to fall overnight because the U.S. monthly supply and demand report is expected to be negative. In addition, the market expects Malaysia's palm oil inventory to increase in October and exports may decline. In addition, as major importing countries such as China, India and Pakistan enter winter, the market expects palm oil demand to decline. The stock of the three major vegetable oils in China is on the low side as a whole. However, with the domestic soybean pressing volume returning to above 2 million tons in Zhou Dou and the expectation that the relevant departments of the state may release the reserve oil, the domestic oil price continues to decline by about 100-200 yuan today. At present, the coastal soybean price is 9900-10050 yuan/ton and the price is 9700-9850 yuan/ton at 24 degrees.

The outer plate continues to remain strong, with the current fish meal outer plate CNF reference $1720/tonne. However, in the domestic imported fish meal market, due to the slow pace of Peruvian fish meal shipment to China, fish meal stocks in our ports have declined and are currently below 200000 tons. However, the price continues to be stable, with Peru's super steam grade fish meal quoted at 11400-11700 yuan/ton. At present, the fishmeal market continues to wait for the announcement of the new season fishing policy to give guidance.

Recently, the European and American markets rose, domestic prices fell back to the annual low, whey powder market prices upside down, traders are reluctant to increase the willingness to sell, the price bottomed out.

Today, lysine is 12.8-13.6 yuan/kg, corn prices are running at a high level, power rationing in northeast and Shandong regions affects factory starts, and manufacturers raise prices frequently. On October 13, Yipin 98 lysine was quoted as 11 yuan/kg, 70% lysine was quoted as 8 yuan/kg, and on October 14, east hope 70% lysine was quoted as 8.7 yuan/kg. On October 25, Chengfu 70% lysine quoted 8.9 yuan/kg. On October 27, plum blossom 98 lysine quoted 12999 yuan/ton and 70 lysine quoted 9188 yuan/ton. Market prices rose to high levels, the downstream wait-and-see mentality increased.

Today's methionine market is 21.2-22 yuan/kg. On October 8, the market said Evonik raised the price of methionine to 22 yuan/kg. On October 13, the market said solid egg manufacturers stopped reporting, domestic factory production is limited. October 18, hijay methionine offer 25 yuan/kg. In September, the import volume rose sharply month-on-month, the domestic liquid egg factory production resumed, the market price shock finishing.

Today's VA market is 290-315 yuan/kg. On October 12, BASF said that the VA1000 equipment upgrade is in progress and the saleable quantity cannot be provided at present. It is expected to update the information in mid-November. On August 25, Jindawei announced that the 800-ton VA oil project in the new plant area would be trial-produced, and the old plant area would be relocated in due course according to the trial-run situation. On September 14, the market said that due to the supply of sodium methoxide, DSM VA plant stopped production until the end of September, reducing production by 30% in the fourth quarter. On October 21, the quotation of BASF vitamin and carotene products increased by 15% ~ 20%. On November 5, the market said that Zhejiang medicine raised its price to 360 yuan/kg, and the market price was high.

Today VE market is 90-95 yuan/kg, and this week the European market is offering 10.5-11.5 euros/kg. Market sources said that Yimante VE factory plans to stop production and upgrade in mid-September for 6 weeks. On September 23, the market reflected that there are factories in Europe that plan to cut production from October to November. On October 18, the market said Xinhe raised its price to 98 yuan/kg. On October 21, the quotation of BASF vitamin and carotene products increased by 15% ~ 20%. On November 5, Zhejiang Medicine raised its price to 108 yuan/kg, and the market was stable and strong.

Today's pig prices rise and fall adjustment, the overall north up south down trend. Yesterday we mentioned that "by the" Ministry of Commerce documents "and the impact of the new crown epidemic, pig prices rose again significantly, but the lack of pigs in the market is still not a lack of meat, consumption has not significantly improved, in the residents of the completion of the stock and the impact of the new crown epidemic weakened, pig prices are still likely to callback." And today's pig price correction area increased significantly, the market supply and demand game, is expected to short-term shock adjustment mainly. As we mentioned earlier, "the sharp and rapid rise in pig prices in October overdrawn the interests of November and the later period. it is expected that the increase in pig prices from November to December will narrow, but on the whole, the price of large pigs on the market from November to December will continue to fluctuate mainly, with interval oscillation adjustment" will not be changed.

Egg prices continue to pull back slightly today. On the supply side, the stock of laying hens is still limited, at a low level in the past five years. With the advent of winter, the production of laying hens in the main northern producing areas has dropped significantly. At present, the supply of eggs is tight, and there are not many surplus goods in all aspects of the market. The supply side is still positive. The high volatility of pig prices and vegetable prices has boosted egg prices, but high egg prices affect digestion and traders are cautious, with the collection and sales-oriented, the public on the high egg prices have resistance psychology, coupled with Chengdu and other places of the epidemic again, the public moderate hoarding, the overall consumer demand decreased, is expected to this week's egg prices in the first half of the week after a moderate correction to stabilize.

Today's elimination of egg chicken prices held steady. At present, the price of eggs has been adjusted back, the price of chicken is relatively high, the elimination mood of farmers has risen, and the elimination volume has risen. At present, the number of old chickens that can be washed has increased but is still not much, and the supply of chicken has increased slightly but is limited. The demand for new purchases is limited, and the overall trend of chicken prices is expected to be slightly weaker this week.

white feather meat chicken]

Today, the price increase of white feather meat chicken narrowed. At present, some areas of the outbreak, resulting in meat and poultry products market goods slowed down, consumer support is limited, today broiler prices continue to rise, but the increase is small. Breeding end profit is still limited, farmers bullish will is urgent, the number of slaughter chickens is not much, slaughter enterprises to buy enthusiasm is still not high. Pig prices and vegetable prices continue to fluctuate at a high level, and there is still some room for meat and poultry prices to rise.

white feather broiler seedlings]

Today, the price of white feather broiler seedlings stopped falling back. At present, the speed of hatching enterprises is not fast. Although the price of white feather chicken continued to rise, but the increase is small, farmers fill the column slightly luxury, fill the column slightly increased, the market demand for chicken seedlings slightly increased to support the price of chicken seedlings continue to rise, it is expected that the price of chicken seedlings this week is weak and strong.

Note: The daily quotation summary deadline for each variety is 11:30, and the difference in statistical time will cause a small difference in the price of the day.